-

-

- Education

- Lawyers

- E-Commerce

- Real Estate

- Physicians

- Non-profit

- Advertising

- Franchise

- Amazon Sellers

- Rental

- Aged-Care

- Farming

- Architects

- Mining

- Manufacturing

- Pharma

- IT Sector

- Travel and Tourism

- Transportation and Trucking

- Power & Infrastructure

- Wholesaler

- Trading firms

- Gems and Jewelry

- Contractors

- Dentists

- Gas Stations

- Tech Startups

- Artists

- Insurance

- Event Management

- Distribution

- Retail Stores

- Veterinary

- Import/Export

- Bookkeeping for Cryptocurrency and Blockchain

- View More industries

-

-

-

- Bookkeeping service

- Payroll management

- Receivables Management

- Payables Accounting

- Grow your Business

- Business Setup in India

- Bookkeeping for CPA’s

- Tax Return Service Business Owners

- Move To Digital

- CFO Services

- Tax Services

- Valuation Services

- Dedicated staff

- White Label services for CPA firms

- Power BI Reporting for Financials

- Backlog Cleanup Service

- Convert to Xero

- Cloud AddOns

- Odoo Development/Customization and Bookkeeping

- Power BI and Google looker studio reporting

-

- Careers

- Contact-us

Home » Wave » Accounting & Bookkeeping » What is Plooto Accounting Software used for?

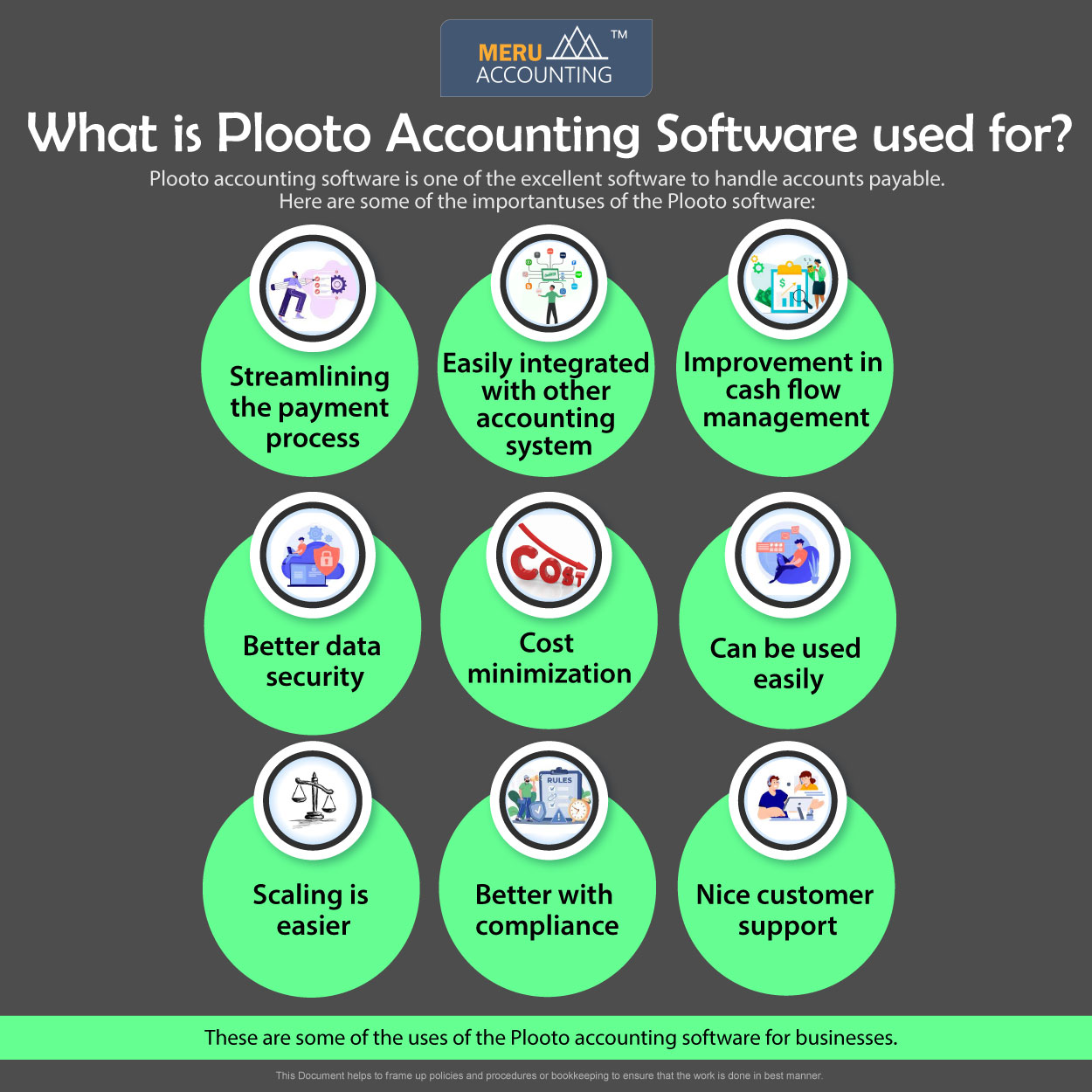

What is Plooto Accounting Software used for?

The accounts payable is one of the important aspects for any business that helps them to improve their financial health. Plooto accounting software is one of the easy-to-use software to handle payable and other accounting tasks efficiently. You can make timely bill payments and automate the process to make it hassle-free. You can achieve faster business payments by using the Plooto software easily. This software can easily integrate with other accounting software to make the process simpler. Plooto accounting software helps in the easy management of the payables which can avoid late payment penalties and get better discounts on timely payments.

What is the main purpose of using Plooto software for business?

Plooto is found to be very effective in managing the cash flow of the business.

Here are some of the main uses of using Plooto accounting software for the business:

Streamlining the payment process

Plooto facilitates electronic payments, allowing businesses to streamline their payment processes. This can save time and reduce manual errors associated with traditional payment methods like checks.

Minimizing the cost

By automating payment processes, Plooto can help reduce costs associated with printing, mailing, and processing paper checks. Additionally, it can potentially minimize late fees by ensuring timely payments.

Improving the cash flow management

Plooto provides businesses with better visibility and control over their cash flow by offering features such as recurring payments, scheduled payments, and real-time tracking of transactions.

Better data security

Plooto employs encryption and secure payment protocols to ensure the security of financial transactions. This makes the businesses have a peace of mind regarding the safety of their payment data.

Easily integrate with accounting systems

Plooto software integrates with various accounting software platforms, such as Xero, QuickBooks Online, and Sage. This helps in streamlining the reconciliation process and providing a seamless flow of financial data between systems.

Ease to use

Plooto’s user-friendly interface and intuitive design make it easy for businesses to set up and use the software without extensive training or technical expertise.

Scalability is easier

Plooto accounting software can accommodate businesses of different sizes, from small startups to large enterprises, allowing them to scale their payment processes as their business grows.

Compliance is simpler

Plooto helps businesses maintain compliance with regulations such as PCI DSS (Payment Card Industry Data Security Standard) and other industry-specific requirements. This can help to avoid the penalties or charges caused due to non-compliance.

Better customer support

Plooto typically offers customer support services to assist businesses with any questions or issues. This helps to ensure a smooth user experience while using this software.

These are some of the main uses of the Plooto software that can improve the cash flow of the business. Plooto offers robust payment automation features; it may not cover all aspects of accounting software functionality such as invoicing, expense tracking, or financial reporting.

If you find it difficult to handle the task using Plooto accounting software then you can outsource this to the experts. Meru Accounting has expertise in using the Plooto software and implementing it as per the requirement. We have worked across different types of clients and helped them bring financial efficiency. Meru Accounting is an expert accounting service-providing company using Plooto.