-

-

- Education

- Lawyers

- E-Commerce

- Real Estate

- Physicians

- Non-profit

- Advertising

- Franchise

- Amazon Sellers

- Rental

- Aged-Care

- Farming

- Architects

- Mining

- Manufacturing

- Pharma

- IT Sector

- Travel and Tourism

- Transportation and Trucking

- Power & Infrastructure

- Wholesaler

- Trading firms

- Gems and Jewelry

- Contractors

- Dentists

- Gas Stations

- Tech Startups

- Artists

- Insurance

- Event Management

- Distribution

- Retail Stores

- Veterinary

- Import/Export

- Bookkeeping for Cryptocurrency and Blockchain

- View More industries

-

-

-

- Bookkeeping service

- Payroll management

- Receivables Management

- Payables Accounting

- Grow your Business

- Business Setup in India

- Bookkeeping for CPA’s

- Tax Return Service Business Owners

- Move To Digital

- CFO Services

- Tax Services

- Valuation Services

- Dedicated staff

- White Label services for CPA firms

- Power BI Reporting for Financials

- Backlog Cleanup Service

- Convert to Xero

- Cloud AddOns

- Odoo Development/Customization and Bookkeeping

- Power BI and Google looker studio reporting

-

- Careers

- Contact-us

Home » Wave » Accounting & Bookkeeping » How Cloud Accounting Software Makes Tax Season Less Stressful?

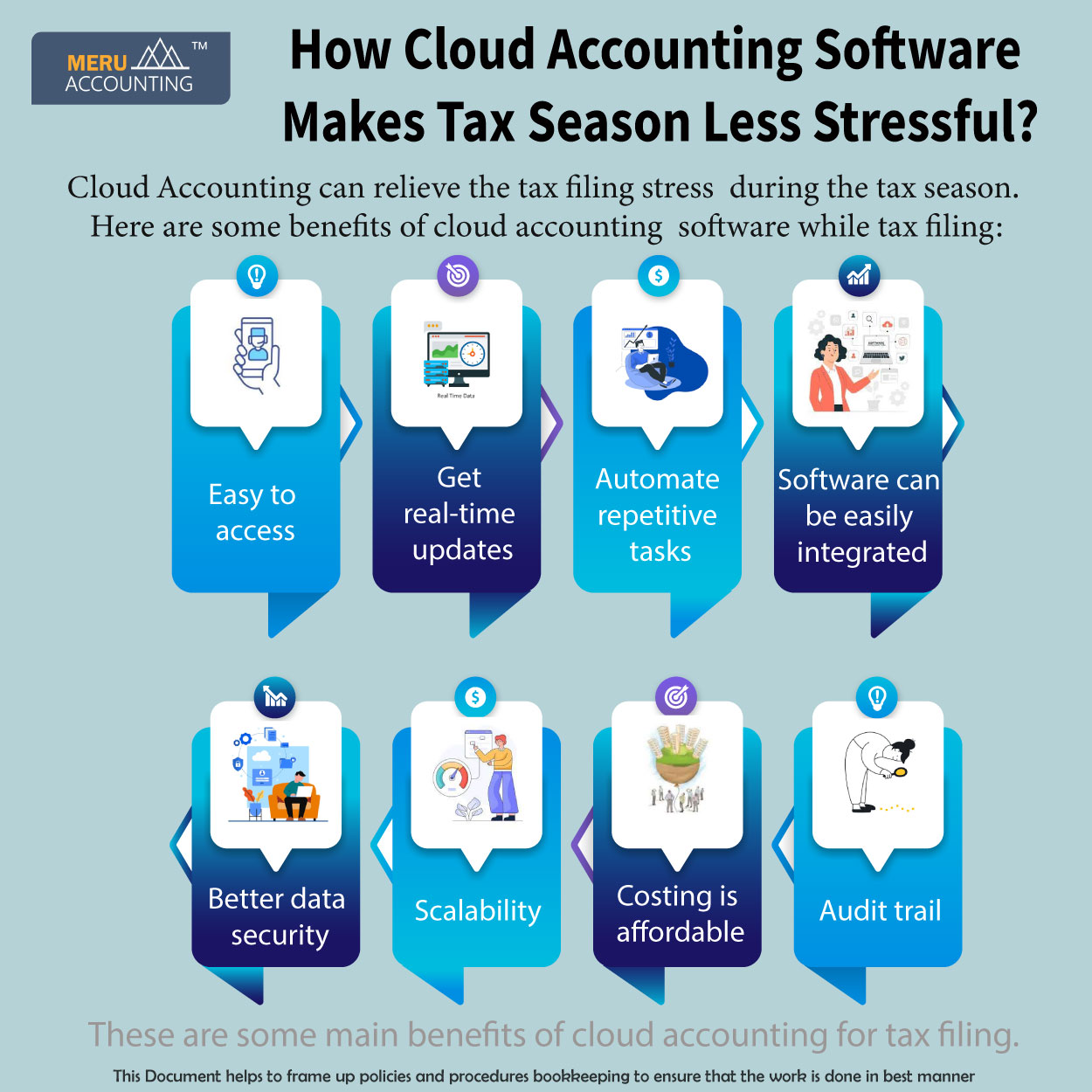

How Cloud Accounting Software Makes Tax Season Less Stressful?

Every business has to file their annual tax return from the region where they are doing business. As the last date of tax filing approaches, the schedule gets busier with tax filing. Tax season always shows more or less dreadful times for tax consultants, accountants, and business owners. Cloud accounting software can help you relieve the stress that is observed during the tax season. Some of the wonderful tools of this software and its ability to handle several accounting aspects can reduce the complexities. There are many benefits of cloud accounting, which can help reduce stress during the tax season. Here, you will learn more about the advantages of cloud accounting for tax filing.How cloud accounting software can help reduce stress during tax season?

Some of the major features and the ability of cloud accounting have simplified tax filing. Here are some major benefits of cloud accounting during tax filing:-

Easy accessibility

-

Real-time updates

-

Automating repetitive tasks

-

Easy integration with software

-

Ensure data security

-

Scalability

-

Affordable costing

-

Audit trail