-

-

- Education

- Lawyers

- E-Commerce

- Real Estate

- Physicians

- Non-profit

- Advertising

- Franchise

- Amazon Sellers

- Rental

- Aged-Care

- Farming

- Architects

- Mining

- Manufacturing

- Pharma

- IT Sector

- Travel and Tourism

- Transportation and Trucking

- Power & Infrastructure

- Wholesaler

- Trading firms

- Gems and Jewelry

- Contractors

- Dentists

- Gas Stations

- Tech Startups

- Artists

- Insurance

- Event Management

- Distribution

- Retail Stores

- Veterinary

- Import/Export

- Bookkeeping for Cryptocurrency and Blockchain

- View More industries

-

-

-

- Bookkeeping service

- Payroll management

- Receivables Management

- Payables Accounting

- Grow your Business

- Business Setup in India

- Bookkeeping for CPA’s

- Tax Return Service Business Owners

- Move To Digital

- CFO Services

- Tax Services

- Valuation Services

- Dedicated staff

- White Label services for CPA firms

- Power BI Reporting for Financials

- Backlog Cleanup Service

- Convert to Xero

- Cloud AddOns

- Odoo Development/Customization and Bookkeeping

- Power BI and Google looker studio reporting

-

- Careers

- Contact-us

Home » Wave » Accounting & Bookkeeping » Challenges and Strategies for Success Payroll Management System.

Challenges and Strategies for Success Payroll Management System.

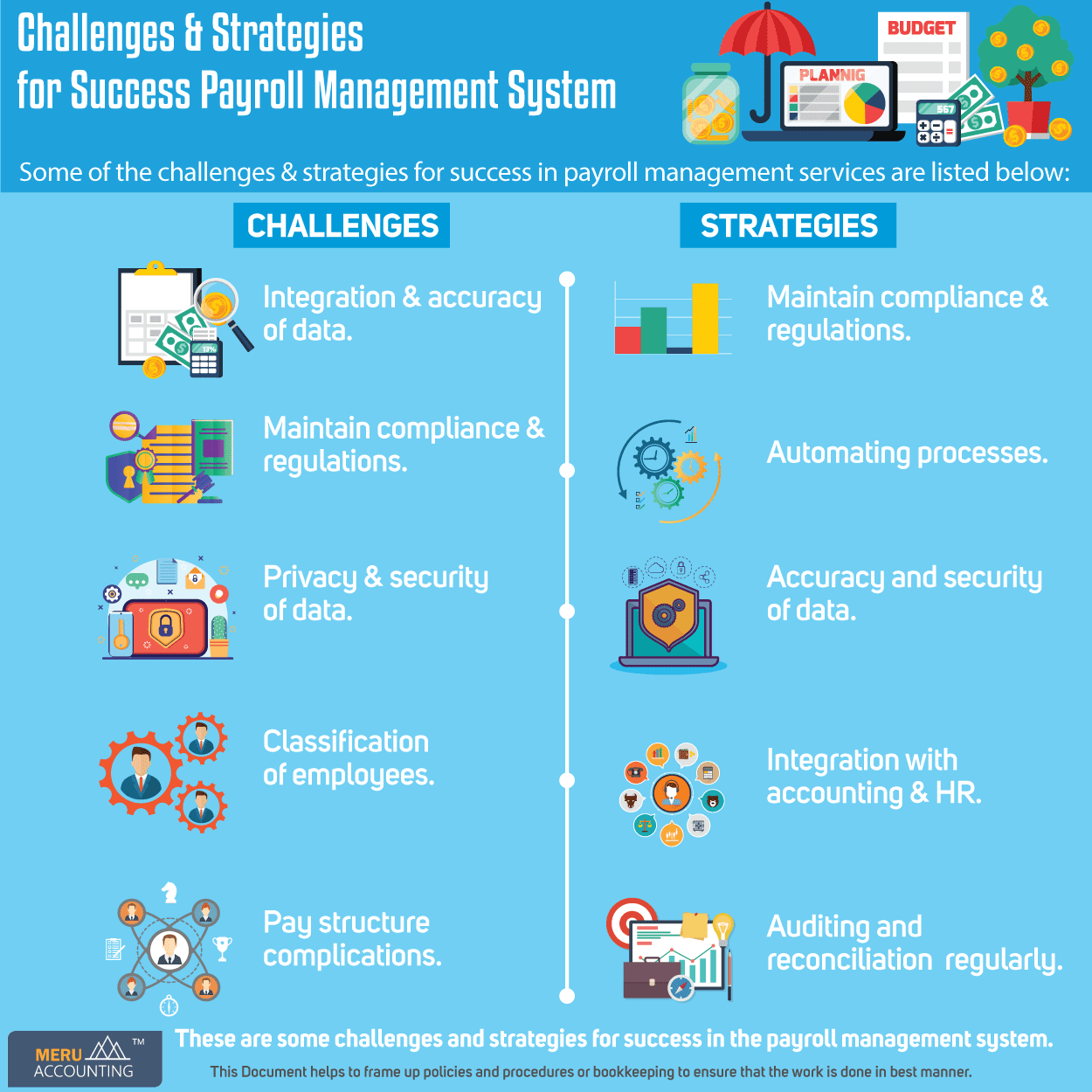

Efficient management of the payroll system is one of the primary aspects of keeping employees productive. However, maintaining an effective payroll management system has always been a challenge for many businesses. The complicated financial and legal implications in it, are mainly responsible for it. Most business organizations do not have effective staff to handle the payroll system. So, outsourcing payroll management services to an external agency can solve many complications of the payroll system. Here, we will look into some challenges and strategies for successful payroll management.

What are the challenges and strategies for a successful payroll management system?

Understanding the challenges and strategies is very important.

Challenges for a successful payroll management system:

Data integration and accuracy

Ensuring accurate data entry and integration with various systems can be challenging. Any discrepancies or errors in data entry can lead to incorrect payments and compliance issues.

Compliance with proper regulations

Payroll management must comply with numerous federal, state, and local regulations regarding aspects like minimum wage, taxes, benefits, and more. Proper regulations keeping and ensuring compliance can be complicated and time-consuming.

Data privacy and security

Payroll data contains sensitive information such as employee salaries, tax information, and personal details. Maintaining robust security measures to protect this data from cyberattacks, breaches, or unauthorized access is important.

Classification of employee

For an effective payroll management system, classifying employees as full-time, part-time, temporary, or independent contractors is essential. Misclassification can result in several penalties.

Complexity in pay structures

Organizations with complex pay structures, such as bonuses, commissions, overtime, and multiple pay rates are complicated. It may face challenges in accurately calculating and processing payments.

Strategies for success in payroll management system:

Compliance with regulations

Ensure that your payroll system complies with all relevant local, state, and federal regulations and reporting requirements. Stay updated with any changes in labor laws to make necessary adjustments in the system accordingly.

Automate the processes

Use payroll software or systems that automate repetitive tasks such as calculating wages, deductions, taxes, and generating reports. Automation helps reduce errors and saves time, allowing your team to focus on more strategic tasks bringing efficiency in payroll management services.

Data accuracy and security

Maintain accurate employee records, including personal information, tax details, salary history, and benefits. Ensure that sensitive payroll data is securely stored, and implement measures such as encryption, access controls, and regular data backups to protect against data breaches or loss.

Integration with accounting and HR

Integrate your payroll system with other key departments such as HR and accounting to streamline processes and ensure data consistency. This integration facilitates seamless sharing of employee information, benefits enrollment, timekeeping data, and financial reporting.

Regular audits and reconciliation

Conduct regular audits and reconciliations of payroll records to identify and rectify discrepancies, and comply with auditing standards. Verify payroll inputs, outputs, and tax filings to prevent errors.

These are some of the challenges and strategies to achieve success in the payroll management system. Businesses can achieve growth better with the proper payroll system.

If you are a business that is facing challenges in bringing an efficient payroll management system, you must go for outsourcing. Meru Accounting has vast experience in providing payroll management services for businesses. We have effectively handled the payroll management successfully of different businesses. Our firm is one of the best payroll management services providing agencies around the world.