-

-

- Education

- Lawyers

- E-Commerce

- Real Estate

- Physicians

- Non-profit

- Advertising

- Franchise

- Amazon Sellers

- Rental

- Aged-Care

- Farming

- Architects

- Mining

- Manufacturing

- Pharma

- IT Sector

- Travel and Tourism

- Transportation and Trucking

- Power & Infrastructure

- Wholesaler

- Trading firms

- Gems and Jewelry

- Contractors

- Dentists

- Gas Stations

- Tech Startups

- Artists

- Insurance

- Event Management

- Distribution

- Retail Stores

- Veterinary

- Import/Export

- Bookkeeping for Cryptocurrency and Blockchain

- View More industries

-

-

-

- Bookkeeping service

- Payroll management

- Receivables Management

- Payables Accounting

- Grow your Business

- Business Setup in India

- Bookkeeping for CPA’s

- Tax Return Service Business Owners

- Move To Digital

- CFO Services

- Tax Services

- Valuation Services

- Dedicated staff

- White Label services for CPA firms

- Power BI Reporting for Financials

- Backlog Cleanup Service

- Convert to Xero

- Cloud AddOns

- Odoo Development/Customization and Bookkeeping

- Power BI and Google looker studio reporting

-

- Careers

- Contact-us

Home » Wave » Accounting & Bookkeeping » Tips for Maximizing the Benefits of CPA Bookkeeping Services for Your Business.

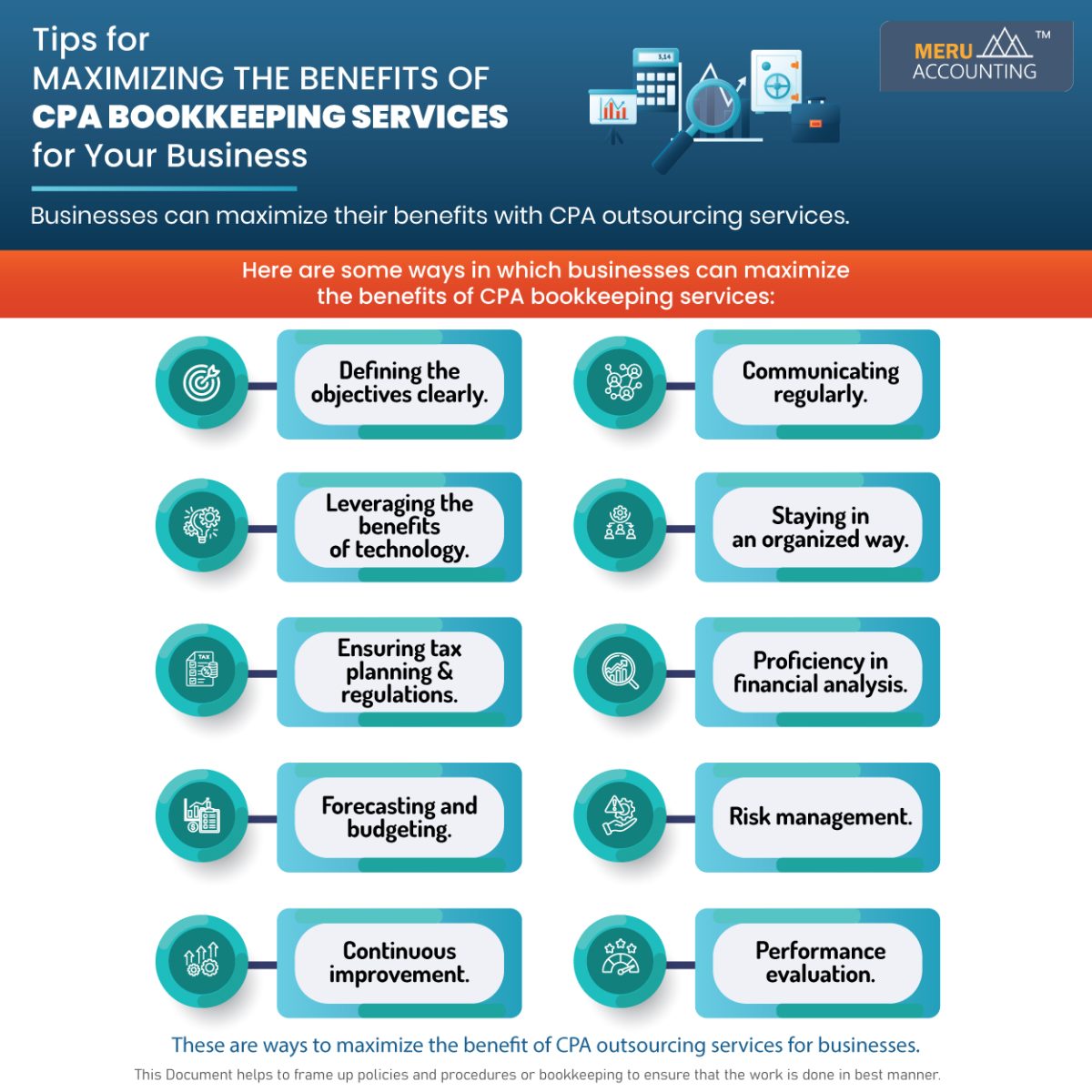

Tips for Maximizing the Benefits of CPA Bookkeeping Services for Your Business.

A lot of businesses have experienced financial inefficiency in their organization. So, they may be looking at the option of outsourcing bookkeeping and accounting tasks to experts. Certified Public Accountants [CPA] professionals can help you maintain the bookkeeping and accounting work. Many organizations have achieved better financial efficiency with CPA bookkeeping services. CPAs being highly qualified, knowledgeable, and trained in the bookkeeping and accounting work, can achieve efficiency. Hence, you need to look for an agency that can provide quality CPA outsourcing services. Businesses can maximize the benefits of CPA outsourcing.

How to maximize the benefits of CPA bookkeeping services for your business?

CPAs can help businesses a lot to maximize their benefits.

Here are some tips with which CPA outsourcing services can benefit the business:

Define the objectives clearly

Clearly outline your business financial objectives and goals to your CPA. This will help them customize their services to meet your specific needs and provide targeted financial advice.

Communicating regularly

Maintain open and regular communication with your CPA bookkeeping services providers. Schedule periodic meetings to discuss your financial situation, review reports, and address any concerns or questions.

Leverage technological benefit

Leverage accounting technology tools and software recommended by your CPA to improve accuracy, streamline processes, and facilitate data sharing. This can include expense-tracking apps, cloud-based accounting platforms, and electronic document management systems.

Stay in an organized pattern

Ensure that your financial documentation remains systematically arranged and regularly updated to maintain organization and accuracy. This includes maintaining accurate records of expenses, income, invoices, receipts, bank statements, etc. A well-organized system will make it easier for your CPA to manage your finances efficiently.

Tax planning and regulations

Collaborate closely with your certified public accountant (CPA) to guarantee adherence to all tax laws and regulations. This partnership ensures compliance and a seamless tax management process. They can help you develop tax planning strategies to minimize tax liabilities. Take advantage of available deductions and credits, and optimize your financial position.

Proficient financial analysis

Take advantage of your CPA’s expertise in financial analysis. They can help you assess performance, analyze financial statements, and make data-driven decisions to improve profitability and financial health.

Forecasting and budgeting

Collaborate with your CPA outsourcing services providers to develop realistic budgets and forecasts based on your financial goals and historical data. Regularly update these projections to track progress and make informed business decisions.

Risk management

Discuss risk management strategies with your CPA to identify and mitigate potential financial risks. This can include insurance coverage, investment diversification, cash flow management, and contingency planning.

Improving continuously

Stay informed about financial best practices, and regulatory changes. Attend workshops, or webinars recommended by your CPA to enhance your financial literacy.

Evaluating the performance

Regularly evaluate the performance of your bookkeeping services. Assess their accuracy, responsiveness, reliability, and value-added contributions to your business. Make adjustments and feedback as needed to optimize the relationship.

These are some ways in which businesses can maximize the benefits of CPA bookkeeping services. CPA bookkeeping services offer a comprehensive range of benefits that contribute to better financial management.

If your business is looking for some professional CPA bookkeeping services, consider Meru Accounting. We provide exceptional CPA outsourcing services. CPAs at Meru Accounting have deep knowledge, qualifications, and experience in bookkeeping and accounting. We provide quality CPA bookkeeping services around the world.