-

-

- Education

- Lawyers

- E-Commerce

- Real Estate

- Physicians

- Non-profit

- Advertising

- Franchise

- Amazon Sellers

- Rental

- Aged-Care

- Farming

- Architects

- Mining

- Manufacturing

- Pharma

- IT Sector

- Travel and Tourism

- Transportation and Trucking

- Power & Infrastructure

- Wholesaler

- Trading firms

- Gems and Jewelry

- Contractors

- Dentists

- Gas Stations

- Tech Startups

- Artists

- Insurance

- Event Management

- Distribution

- Retail Stores

- Veterinary

- Import/Export

- Bookkeeping for Cryptocurrency and Blockchain

- View More industries

-

-

-

- Bookkeeping service

- Payroll management

- Receivables Management

- Payables Accounting

- Grow your Business

- Business Setup in India

- Bookkeeping for CPA’s

- Tax Return Service Business Owners

- Move To Digital

- CFO Services

- Tax Services

- Valuation Services

- Dedicated staff

- White Label services for CPA firms

- Power BI Reporting for Financials

- Backlog Cleanup Service

- Convert to Xero

- Cloud AddOns

- Odoo Development/Customization and Bookkeeping

- Power BI and Google looker studio reporting

-

- Careers

- Contact-us

Home » Wave » Accounting & Bookkeeping » Personal Tax Accountant Services: Your Guide to Effective Tax Management

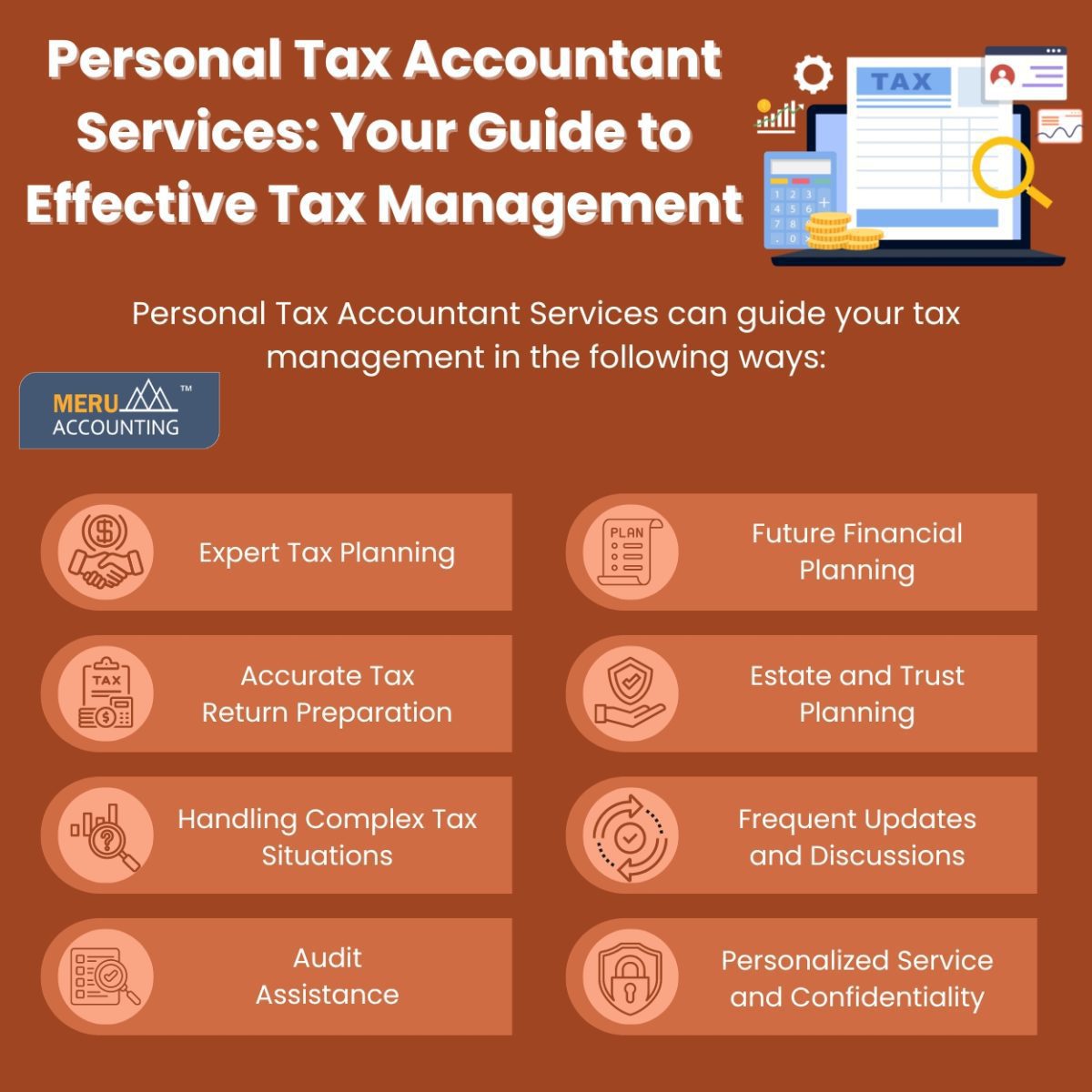

Personal Tax Accountant Services: Your Guide to Effective Tax Management

Managing the complexities of tax law can be a difficult task for most individuals, especially when facing the multiple responsibilities of financial planning, investments, and ensuring compliance with local, state, and federal laws. Personal tax accountant services provide specialized knowledge that helps reduce your taxes and improve your financial management. Without professional guidance, managing the tax management complexity can be quite difficult. Services provided by personal tax accountants provide clients with specific expertise and experience to help them maximize their tax conditions.

Optimizing Advantages through Personal Tax Accountant Services

The following eight crucial reasons that personal tax accountant services can improve your tax management strategy are listed below:

Expert Tax Planning:

To assist you in managing your money in a way that reduces your tax liability, personal tax accountants offer strategic planning services. Advice on credits, tax deductions, and the timing of income and expenses are all included in this.

Accurate Tax Return Preparation:

One of the fundamental roles of a personal tax accountant is to ensure accurate and compliant tax return preparation. They stay up-to-date with the latest tax laws to guarantee that every return they prepare is correct and optimized for the best possible outcome.

Handling Complex Tax Situations:

If you have multiple income streams, investments, or international financial interests, personal tax accountant services are invaluable. They specialize in navigating complex tax codes and can handle intricate financial data efficiently.

Audit Assistance:

Having a personal tax accountant on your side can be very helpful during an IRS audit. They can offer the required paperwork, clarify the specifics of your tax return, and act as an advocate for you.

Future Financial Planning:

In addition to helping with specific financial planning, personal tax accountants may also help you comprehend the long-term tax ramifications of certain investments and savings strategies, such as retirement planning.

Estate and Trust Planning:

Personal tax accountant services include tax guidance and filing that complies with federal and state rules, ensuring that beneficiaries receive their due without needless tax costs. This is useful for people who need to handle estate or trust funds.

Frequent Updates and Discussions:

It can be difficult to stay up to date with the regular changes made to tax regulations. Individual tax accountants provide regular updates and consultations to ensure that your financial activities remain compliant with current laws.

Personalized Service and Confidentiality:

In contrast to generic tax software, personal tax accountants provide a service that is specifically customized for your financial circumstances. They also guarantee trust and confidentiality by upholding professional ethics.

Conclusion

Meru Accounting possesses individuals who manage the complexities of personal taxes. Whether you aim to maximize your tax returns, plan your financial future, or simply ensure compliance with tax laws, our knowledgeable tax professionals are here to assist. The team at Meru Accounting provides tailored advice and strategies that are aligned with your unique financial situation. By partnering with us, you can be confident that you’re making the most informed decisions for your financial well-being.