What is the Depreciation Fund and Its Accounting

When a business invests in assets like machines, tools, or equipment, those items don’t hold their value forever. With regular use, they wear out and lose worth. This decline in value is known as depreciation. To deal with it smartly, many businesses set up what’s called a depreciation fund.

Understanding What is Depreciation Fund

A depreciation fund is money set aside over time to prepare for replacing worn-out assets. Instead of facing a large cost all at once, a business contributes smaller amounts regularly. This fund grows quietly in the background, ready to cover the cost of new equipment when needed.

This approach has clear benefits. It protects the business from sudden large expenses and removes the need to take loans or slash budgets when assets break down. It also keeps financial reports tidy and consistent.

Starting a depreciation fund early helps a business plan better. It allows the cost of big purchases to be spread out over several years. That way, the business stays financially steady and its operations keep moving without interruption.

Purpose of Creating a Depreciation Fund

It helps replace assets without loans. It ensures steady business cash flow. Regular savings prepare firms for future asset costs. This approach avoids sudden expenses and maintains asset planning efficiently.

Keeps the Business Running

Costly machines and tools lose value over time. Regular savings help buy new ones. This avoids cash flow issues and keeps work going without a break or financial strain.

Avoids Sudden Financial Pressure

Big repairs or new purchases can break the budget. A set fund means no stress. The business can buy new items quickly without needing loans or cutting other costs.

Supports Long-Term Planning

It helps track asset life and plan. Business owners know when funds are needed. This makes yearly budgets easier and cuts down on last-minute spending.

Supports Financial Discipline

Saving for assets builds a smart habit. It avoids panic when replacements are due. This steady plan helps managers think ahead and act without delay.

Understanding what is depreciation fund gives firms a clear way to handle long-term asset plans without risk or debt.

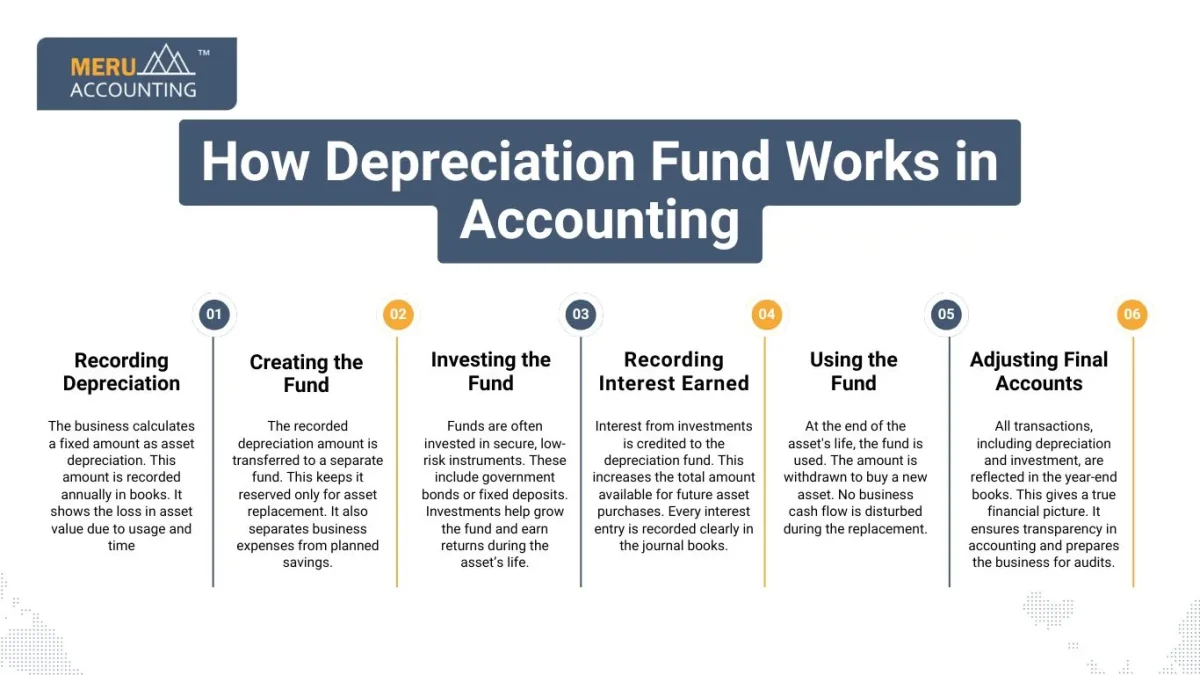

How Depreciation Fund Works in Accounting

Recording Depreciation

The business calculates a fixed amount as asset depreciation. This amount is recorded annually in books. It shows the loss in asset value due to usage and time.

Creating the Fund

The recorded depreciation amount is transferred to a separate fund. This keeps it reserved only for asset replacement. It also separates business expenses from planned savings.

Investing the Fund

Funds are often invested in secure, low-risk instruments. These include government bonds or fixed deposits. Investments help grow the fund and earn returns during the asset’s life.

Recording Interest Earned

Interest from investments is credited to the depreciation fund. This increases the total amount available for future asset purchases. Every interest entry is recorded clearly in the journal books.

Using the Fund

At the end of the asset’s life, the fund is used. The amount is withdrawn to buy a new asset. No business cash flow is disturbed during the replacement.

Adjusting Final Accounts

All transactions, including depreciation and investment, are reflected in the year-end books. This gives a true financial picture. It ensures transparency in accounting and prepares the business for audits.

Types of Assets Covered Under Depreciation Fund

Machinery and Equipment

Heavy machinery loses value with use and age. This fund ensures businesses save money yearly. This allows them to replace machines without affecting other operating expenses or available capital.

Vehicles

Company-owned cars, trucks, or vans decline in value yearly. A fund built for vehicle replacement helps maintain a reliable fleet. It also avoids sudden expenses when multiple vehicles need changes.

Office Furniture

Desks, chairs, filing cabinets, and other furniture face regular wear. They require structured replacement plans. A fund built through regular savings allows smooth upgrades without financial strain or work disruption.

Computer Systems

Laptops and desktop systems become outdated within a few years. A depreciation fund supports planned upgrades. It ensures teams have access to efficient technology and protects productivity from system failure.

Factory Tools

Tools used in production lines wear out due to regular use. Saving for tool replacement avoids last-minute costs. It also keeps the assembly line functional and avoids unplanned downtime.

Electrical Appliances

Air conditioners, UPS systems, and generators degrade over time. A dedicated fund ensures these appliances are replaced without borrowing. It helps maintain working conditions and reduces long-term maintenance expenses.

Depreciation Fund vs General Reserve: Key Differences

Point of Difference | Depreciation Fund | General Reserve |

Primary Purpose | Used to save for replacing fixed assets after their useful life ends. | Created to meet future needs or strengthen the business’s financial position. |

Fund Usage | Meant only for asset replacement; cannot be used for other business activities. | It can be used for any purpose, like expansion, paying off debts, or emergencies. |

Source of Creation | Built through fixed yearly depreciation charges recorded in accounts. | Comes from retained profits or surplus after yearly earnings. |

Investment Practice | Often invested in safe funds to grow until asset replacement is due. | May or may not be invested, depending on business policy and goals. |

Accounting Treatment | Treated as a planned expense and shown through depreciation entries. | Treated as part of the profit appropriation in financial statements. |

Impact on Cash Flow | Reduces yearly available cash but supports smooth asset replacement later. | Does not affect cash directly unless funds are withdrawn for business use. |

Benefits of Maintaining a Depreciation Fund

Reduces Budget Shock

Replacing major assets can cost a large amount at once. A fund spreads this cost over time. It avoids sudden strain on annual budgets and improves cash management.

Improves Cash Flow Planning

Saving for asset replacement in small parts aids planning. The business can predict when money is needed. This avoids gaps in working capital and improves fund control.

Increases Financial Stability

With a dedicated fund, businesses avoid last-minute borrowing. This reduces interest payments and keeps the balance sheet strong. It also adds confidence in long-term planning and decisions.

Helps in Accurate Reporting

Depreciation charges match yearly asset usage and income. It helps show true profits and losses. The business avoids overstated profits and ensures reliable financial statements for stakeholders.

Avoid Business Loans

With money already saved, there’s no need for loans. Businesses don’t need to rely on external finance to buy new assets. This reduces debt and lowers financial risk.

Supports Smooth Operations

Planned asset replacement avoids disruptions in service or production. Employees continue working without waiting for broken tools or machines. The business maintains output levels and avoids delays.

Example Entries of Depreciation in Journals

To record yearly expenses, the business debits the expense account. It credits the fund account to show the value drop. This adds to the fund each year. When the saved amount is invested, the business debits the investment account and credits the bank account. This shows that cash moved into an asset plan. When the investment earns money, the bank account is debited, and the income account is credited. These records show how the fund grows, how much is saved, and how much is earned. This clear method helps firms plan better and keep full control over asset value and cash use.

Meru Accounting knows how to manage assets for all types of business. We help firms track asset life and set up a smart depreciation fund. Our methods are clean and easy to follow. We use clear rules to set up your depreciation and track it with care If you need any help with creating and managing your depreciation fund, contact us now!.

FAQs

- What is Depreciation Fund, and how is it used in accounting?

It is a savings plan made for asset replacement. Firms invest the funds safely. Later, they use it to buy new machines or tools without using daily business cash. - Why do companies save money for asset replacement?

It helps avoid large costs when machines stop working. Saving early means no stress. It also keeps business work smooth and avoids sudden breaks in service or cash loss. - What kind of assets need regular replacement planning?

Tools, vehicles, and machines wear out over time. If not replaced, work can stop. Having a plan makes sure the firm stays ready when key items lose their usefulness. - Can saved funds be used for other business needs?

No, the saved amount must stay untouched. Using it elsewhere may cause cash gaps. It’s set aside only for buying new items when current ones no longer work well. - Who manages the fund created for asset replacement?

The finance team or the accountant handles the process. They record savings, invest funds, and track when money is needed. Good control helps firms use funds when the time comes. - How does this fund support business planning and growth?

It helps set clear money goals. Firms can replace tools on time. This avoids debt and keeps operations smooth. It also builds trust in the business’s money planning over time.