How to apply for an ITIN from India?

Many Indians earn income from the USA through jobs, investments, or property. To meet US tax rules, such people need an ITIN. The ITIN helps in filing tax returns and claiming refunds in the USA. Without this number, it becomes hard to stay tax compliant.

Understanding how to apply for an ITIN from India can save you time and effort. It also reduces the chances of rejection by the IRS. With the right process and correct documents, you can get your ITIN without facing issues. In this blog, we will explain every step in simple words.

What is an ITIN Number in the USA?

- ITIN means Individual Taxpayer Identification Number, given by the IRS.

- It is a 9-digit number that looks like an SSN but starts with the number 9.

- This number is only for tax reporting and does not allow you to work.

- Foreign nationals, non-residents, and dependents often need this ID.

- Knowing what is ITIN number is in the USA is the first step before applying.

Why Do You Need an ITIN Number in India?

- You need it to file US tax returns if you have US income.

- It helps you claim refunds and benefits under tax treaties.

- An ITIN may be required to open some US bank accounts.

- It is useful when you buy or sell property in the USA.

- Having an ITIN number in India makes tax matters much easier.

Who Can Apply for an ITIN USA?

- Non-resident aliens who must file US tax returns.

- Spouses and dependents of US citizens or green card holders.

- Students, teachers, or researchers with income in the USA.

- People from India owning rental or other property in the USA.

- Anyone not eligible for an SSN but needing an ITIN USA for taxes.

Documents Needed for ITIN Application

- A valid passport is the most common document accepted.

- National ID cards can be used if a passport is not provided.

- Birth certificates are often required for children and dependents.

- Voter ID or a valid Indian driving license may also be accepted.

- Proof of US income or a US visa may also be needed in some cases.

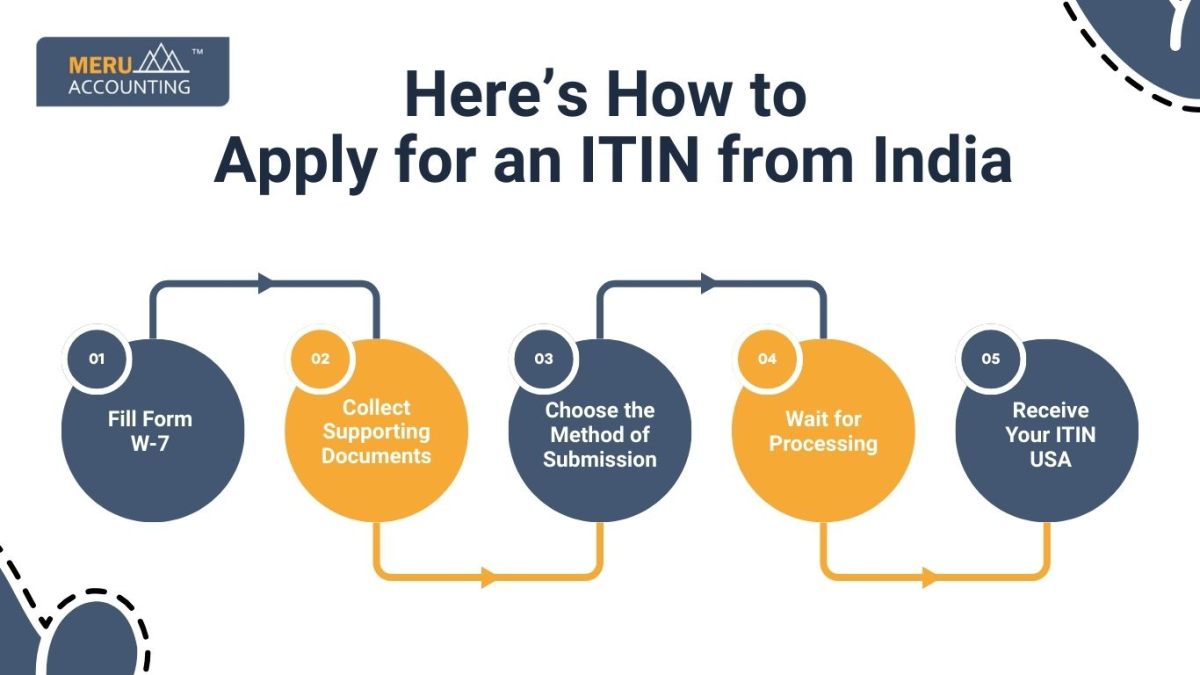

Here’s How to Apply for an ITIN from India

Step 1: Fill Form W-7

- The W-7 form is the IRS application form for an ITIN.

- You must fill it with correct details like name, address, and reason.

- Select the right category to explain why you need an ITIN number USA.

Step 2: Collect Supporting Documents

- Gather all valid IDs that prove your identity and foreign status.

- The IRS accepts original passports or certified copies from the issuer.

- Double-check that all documents are clear, correct, and not expired.

Step 3: Choose the Method of Submission

You have three options:

- By Mail

- Send Form W-7 along with documents directly to the IRS office.

- The address is IRS, ITIN Operation, Austin, Texas, USA 73301-0020.

- Send Form W-7 along with documents directly to the IRS office.

- Through an IRS Acceptance Agent

- Agents in India authorized by the IRS can help you apply.

- They check your documents and forward them to the IRS office.

- Agents in India authorized by the IRS can help you apply.

- In Person (USA)

- If you are in the USA, you can visit IRS centers.

- This is faster as you submit documents directly.

- If you are in the USA, you can visit IRS centers.

Step 4: Wait for Processing

- The IRS usually takes 7 to 11 weeks to process an application.

- During the tax season, the process can take even more time.

- You can check with your agent or the IRS for status updates.

Step 5: Receive Your ITIN USA

- Once approved, the IRS sends your ITIN by mail.

- You can then use this number for filing US taxes and claims.

- Keep it safe, as you may need it every year for taxes.

What is Form W-7?

It is a requirement to apply for the ITIN. Form W-7 details the following information for an individual-

- The purpose of the application.

- Name and address of the individual. It contains both mailing and foreign addresses, if any.

- Date of birth and place of birth of the individual.

- The individual’s nationality.

- The individual US Visa number, if applicable.

- Details of the documents submitted to substantiate the individual’s identity.

- Foreign tax ID number, if applicable,

Key Points to Remember While Applying

- Always provide correct and complete details in Form W-7.

- Use certified copies of the passport if not sending the original.

- Keep a copy of the form and documents for your records.

- Do not apply unless you have a valid reason for an ITIN.

- Remember, an ITIN does not give you permission to work in the USA.

Common Mistakes to Avoid

- Many people forget to sign the W-7 form, which causes rejection.

- Submitting expired or unclear documents is another common error.

- Some applicants do not attach proof of tax return when needed.

- Choosing the wrong reason on the form also leads to delays.

- These mistakes slow down the process of getting an ITIN number.

How to Get an ITIN Number Quickly

- The fastest way is to use a Certified Acceptance Agent in India.

- Double-check the W-7 form and documents before submission.

- Avoid applying during the peak filing season if possible.

- Always track your courier if you send documents to the IRS.

- Correct and timely submission makes it easier to get your ITIN.

Validity of ITIN USA

- An ITIN stays valid as long as you use it on tax returns.

- If not used for three years, the IRS may deactivate it.

- Renewal can be done by filing a new W-7 with documents.

- Some ITINs with certain digits expired earlier and need renewal.

- Always check IRS updates about ITIN renewal rules.

ITIN vs SSN – Key Difference

Point | ITIN | SSN |

Issued By | IRS | Social Security Administration |

Purpose | Tax filing and reporting | Employment, benefits, and taxes |

Who Gets It | Foreign nationals, non-residents | US citizens, residents, and authorized workers |

Work Rights | No | Yes |

Validity | Till active with the IRS | Lifetime |

Benefits of an ITIN Number in India

- It helps you follow tax laws and avoid penalties in the USA.

- You can claim tax refunds and benefits from the IRS using an ITIN.

- It supports property transactions if you own US real estate.

- Some banks may allow you to open accounts with an ITIN.

- Dependents and spouses can also claim benefits through an ITIN.

Renewal of ITIN USA

- Renewal is needed if the ITIN is not used for three years.

- A fresh W-7 form must be submitted with proof again.

- Renewal is free and handled by the IRS directly.

- Always renew on time to avoid issues in tax filing.

- Dependents must also renew their ITIN if it expires.

Can an ITIN Be Used as Identification?

- ITIN is only for tax purposes and cannot replace a passport or visa.

- It cannot be used for legal identification in India or the USA.

- Some banks in the USA may accept it along with other documents.

- Always remember, it is not proof of legal immigration status.

Tips for Indian Applicants

- Always read the latest IRS guidelines before applying.

- Use certified copies from the Indian passport office if needed.

- If mailing, use a trusted courier service for safe delivery.

- Keep scanned copies of all forms and documents for safety.

- Hiring a tax professional can help you avoid costly errors.

Can an ITIN Help in Buying Property in the USA?

- Yes, foreigners can buy property in the USA with an ITIN.

- An ITIN is needed to pay property taxes to the IRS.

- It also helps in getting rental income taxed properly.

- Without an ITIN, property transactions can become difficult.

Understanding how to apply for an ITIN from India is very important for Indians with US income or tax needs. Having the right documents, filling Form W-7 correctly, and submitting it through the proper channel ensures that you get your ITIN number without delays. Whether you are a student, dependent, or property owner, an ITIN helps you meet US tax rules.

At Meru Accounting, we provide complete support for Indian clients who need an ITIN. Our experts guide you step by step with form filing, document checks, and renewals. We also assist with tax returns in the USA once your ITIN is approved. With our help, the process of getting your ITIN number in India becomes simple and stress-free. Choosing Meru Accounting means you save time, avoid errors, and stay compliant with both Indian and US tax systems.

FAQs

- What is an ITIN number in the USA?

It is a 9-digit tax ID issued by the IRS for those not eligible for an SSN. - How to get an ITIN number from India?

You must file Form W-7 with documents either by mail or via an agent. - How long does it take to receive an ITIN USA?

Usually 7–11 weeks, but sometimes longer in busy tax season. - Is an ITIN number from India valid for work in the USA?

No, an ITIN is only for tax reporting and not for employment. - Can I apply for an ITIN without going to the USA?

Yes, you can apply by mail or through IRS-certified agents in India. - Do children need an ITIN number USA?

Yes, if they are dependents claimed on a US tax return. - Does ITIN expire?

Yes, it expires if unused for 3 years, but renewal is possible.