Guide to Law Firm Accounting: Best Practices and Tips

Law firm accounting is not the same as normal business books. It deals with client funds, trust accounts, and strict rules that lawyers must meet. Even a small error can lead to compliance issues and loss of trust. This guide gives you the best tips to keep your books clean, safe, and in line with the law. From trust fund rules to tax prep, each part plays a role in smooth work. With clear steps, law firms can save time, cut risk, and serve clients well. Strong accounting builds trust and helps the firm grow with ease.

What Is Law Firm Accounting?

Law firm accounting is different from standard business accounting. It involves handling client trust accounts, tracking billable hours, and following strict rules. Because law firms deal with client funds and legal trust accounts, they must follow both legal and ethical standards.

If you’re starting a law firm or want to fix your books, it’s key to know the basics. Effective accounting helps you follow rules, avoid fines, and make smart choices. Many firms use law firm accounting services to save time and reduce risk.

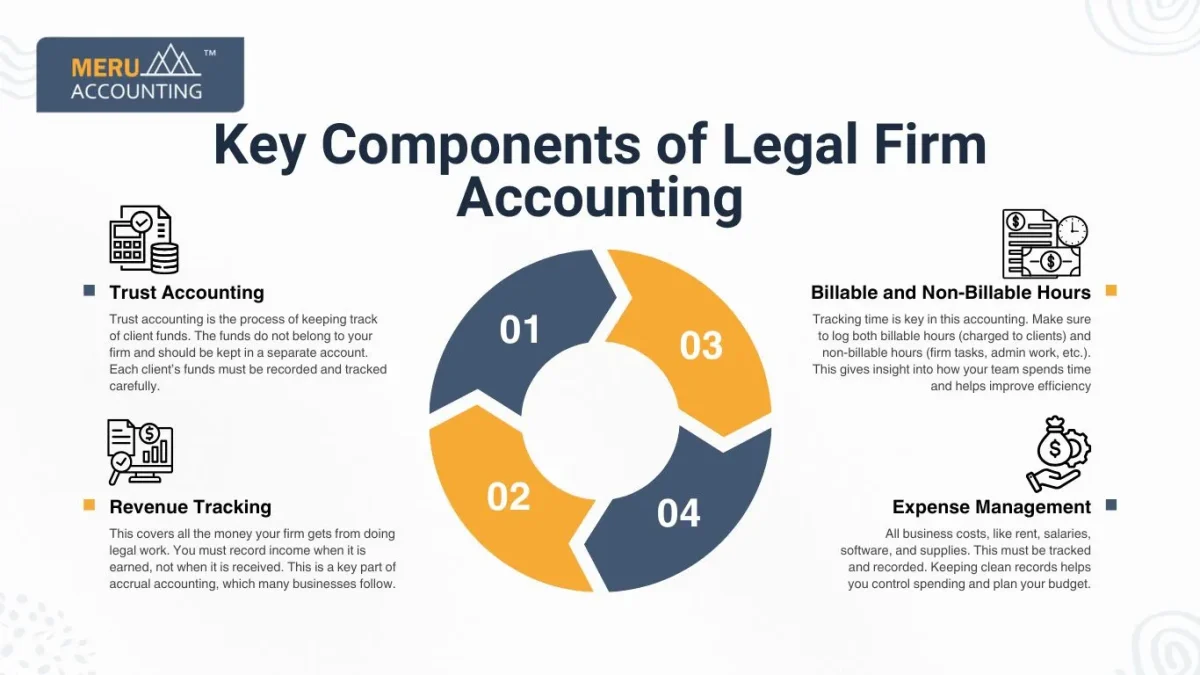

Key Components of Legal Firm Accounting

Understanding the parts of this accounting is key to managing your firm well. Let’s break down the main areas:

1. Trust Accounting

Trust accounting is the process of keeping track of client funds. The funds do not belong to your firm and should be kept in a separate account. Each client’s funds must be recorded and tracked carefully.

2. Revenue Tracking

This covers all the money your firm gets from doing legal work. You must record income when it is earned, not when it is received. This is a key part of accrual accounting, which many businesses follow.

3. Expense Management

All business costs, like rent, salaries, software, and supplies. This must be tracked and recorded. Keeping clean records helps you control spending and plan your budget.

4. Billable and Non-Billable Hours

Tracking time is key in this accounting. Make sure to log both billable hours (charged to clients) and non-billable hours (firm tasks, admin work, etc.). This gives insight into how your team spends time and helps improve efficiency

Top tools for managing Law Firms’ finances

Legal-Specific Accounting Software

Pick tools built for law firms, such as Clio, CosmoLex, or MyCase. These apps have billing, time logs, and trust fund tools all in one place.

Time Tracking Tools

Use apps that track billable time as you work. This way, no hours are lost, and your firm gains more pay.

Expense Tracking Apps

Log costs with apps like QuickBooks or Expensify. Snap a pic of your receipt, and the app stores it for your files.

Bank Reconciliation Features

Choose a tool that links to your bank and lets you check each month. This cuts down on errors and saves hours.

Cloud-Based Systems

Cloud tools let you reach your data from any site. This works well for remote work or when you are out of the office.

Using these tools helps cut down on manual work and lowers the risk of errors in your firm’s books.

How Law Firm Accounting Services Can Help

Law firm books can turn complex fast. Trust funds, bills, and tax laws all need close care. Law firm accounting services help manage these tasks with skill and ease.

These services track books, watch funds, and take on key jobs like bank checks, time logs, and tax tasks. With expert help, your team saves time and avoids high-cost mistakes.

Law firm services also keep records neat and easy to check. This is key when audits come up or when you need to track cash flow.

If time is short or rules seem hard, these services are a smart choice. They keep books clean and your firm’s work on track.

Compliance and Ethical Considerations

Accounting of a law firm must follow strict rules from both the IRS and your local bar association. Here are a few key things to keep in mind:

Follow Bar Association Rules

Many states have guidelines for managing client trust accounts. These rules cover deposits, withdrawals, and recordkeeping. Make sure your system follows these rules exactly.

Keep Clear Records

Always keep detailed records of trust accounts, time entries, and invoices. These records should be easy to access in case of an audit.

Avoid Commingling

As mentioned earlier, do not mix client money with your own. Use a separate Interest on the Lawyers’ Trust Account (IOLTA) when required.

Stay Informed

Laws and accounting standards can change. Stay up to date with new rules and make changes as needed.

Ethical mistakes in this accounting can result in fines, lost licenses, or damage to your reputation. That’s why accuracy and compliance are so important.

When to Hire a Professional for Legal Accounting

While some law firms manage their accounting in-house, it often makes sense to get outside help. Here’s when you should consider hiring a pro:

You’re Too Busy

If you’re spending more time on books than on clients, it’s time to get help. A professional accountant will free up your time so you can focus on legal work.

Your Books Are a Mess

If your records are behind or full of errors, an expert can clean things up and get you back on track.

You Don’t Know the Rules

Not all accountants understand the special rules for law firms. Look for someone with experience in the legal field.

You’re Growing Fast

As your firm grows, so does the need for proper accounting. A professional can set up systems to handle more clients, staff, and funds. Hiring the right person or firm can save you time, reduce risk, and help your practice grow.

If you feel lost with trust rules or time billing, law firm accounting services are worth the cost. They free up your time so you can focus on legal work.

Common Challenges in Legal Firm Accounting

Even small mistakes in this accounting can lead to big problems. Below are key issues many law firms face.

Mixing Business and Trust Accounts

Keeping client funds with your firm’s money can cause legal trouble. Accounting of law firm rules requires strict separation.

Poor Tracking of Billable Hours

Missing billable hours means lost income. Accurate time logs are key to getting paid for your work.

Not Following Accounting Standards

Law firms must follow legal and tax rules. Breaking them can lead to fines or lost licenses.

Lack of Regular Financial Reports

Without monthly reports, you can’t track cash flow or spot money issues. Reports keep your firm on track.

When tasks pile up, small firms may struggle to track trust funds or bill hours. Law firm accounting services can handle these duties and keep records up to date.

Best Practices for Accurate Legal Firm Accounting

Legal firm accounting should be both detailed and clear. Follow these best practices to make sure your firm stays on track:

Use a Chart of Accounts

Set up a clear chart of accounts to sort income, costs, assets, and liabilities. Use categories that match how law firms work.

Reconcile Accounts Monthly

Each month, check that your books match your bank statements. This helps catch errors early and ensures your books are accurate.

Use Accrual Accounting

Even if you’re a small firm, accrual accounting gives a better view of your financial health. It shows income when earned and costs when owed.

Stay on Top of Invoicing

Send out invoices quickly and follow up on payments. Late payments can affect your cash flow.

Track Key Metrics

Watch metrics like collection rate, realization rate, and profit margins. These show how well your firm is doing and help with planning.

Set up a clear chart of accounts and track every entry. You can also use legal firm accounting services to check your reports and keep your data clean.

Legal firm accounting helps legal firms stay organized, follow the rules, and understand their money better. With the right tools and clear processes, you can avoid errors and keep your firm running smoothly.

Meru Accounting supports law firms with their accounting needs. Our team understands trust accounts, legal billing, and compliance. We aim to make your accounting tasks easier and more accurate.

FAQ

- What is law firm accounting?

Legal firm accounting tracks money for legal firms, including income, costs, and client trust funds.

- Why is trust accounting important for law firms?

Trust accounting keeps client funds safe and separate. It helps law firms follow strict legal rules.

- How often should law firms reconcile accounts?

Firms should reconcile accounts every month. This keeps records clean and avoids costly mistakes.

- What reports do law firms need each month?

Firms should review income, expenses, and trust balances monthly to stay on top of their finances.

- When should a law firm hire an accounting expert?

If books are messy, time is short, or rules are unclear, it’s time to hire help. A pro ensures full compliance.