Outsourcing Bookkeeping Services for US Businesses

Bookkeeping is the foundation of every business. Clear and accurate records show how money moves in and out. Without this, owners may miss signs of loss or fail to meet tax rules, which is why outsourcing bookkeeping services has become a smart choice. Many US businesses now rely on outsourced bookkeeping for USA companies to handle this important task with care and skill.

Managing accounts in-house takes more effort, staff, and money. Owners need to hire, train, and monitor employees, which adds stress. By outsourcing bookkeeping services, businesses can shift these duties to experts who already know the job. This option saves money and gives owners more time to grow their company.

Why Businesses Need Outsourced Bookkeeping

- Bookkeeping requires focus and precision. A single error can create big problems later.

- Mistakes in accounts can result in tax issues and penalties. Clean books prevent such risks.

- Many business owners do not have enough time to manage accounts daily. Outsourcing solves this gap.

- Skilled experts in outsourced teams bring both experience and accuracy. Outsourcing bookkeeping services makes the work reliable and stress-free.

- Owners can put more energy into growth while experts take care of financial records. This balance helps both.

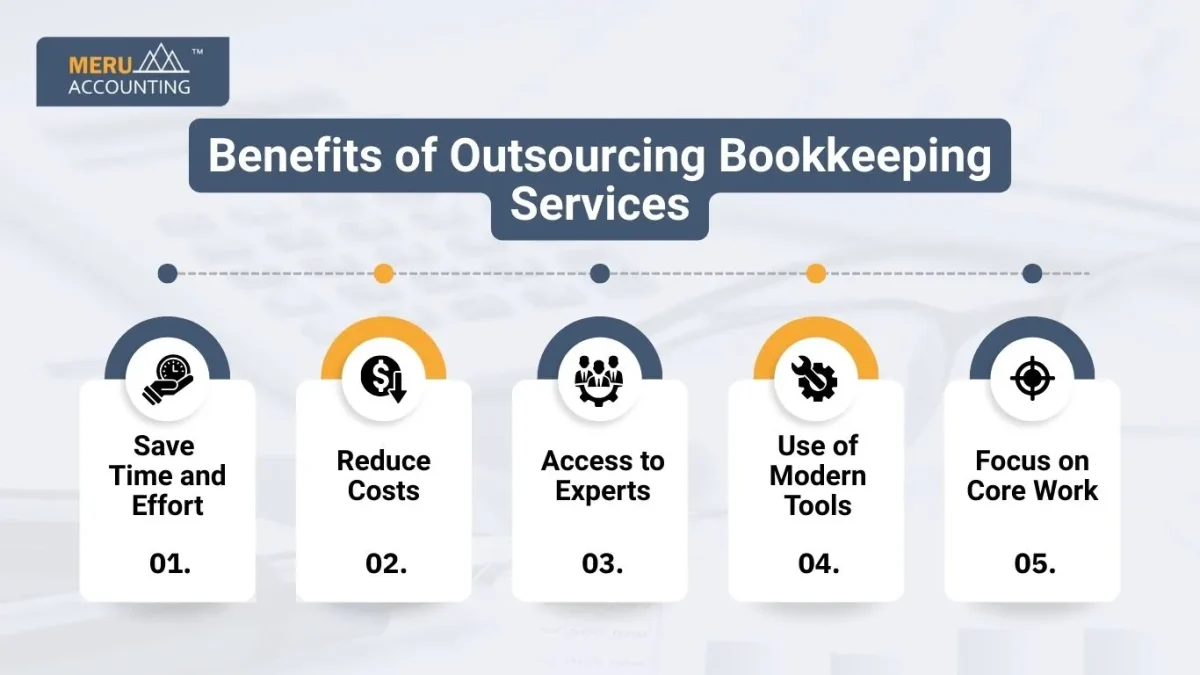

Benefits of Outsourcing Bookkeeping Services

1. Save Time and Effort

- Owners avoid spending long hours on data entry. This keeps their focus on the business.

- The saved time can be used to improve sales, customer care, and new projects. Growth comes faster.

2. Reduce Costs

- Hiring full-time staff for bookkeeping costs more. Outsourcing cuts this burden.

- You save on salaries, training, and benefits. Money saved can support other business needs.

3. Access to Experts

- Outsourced teams include trained bookkeepers who know US rules. Their work reduces errors.

- They also keep track of tax updates. This ensures that accounts remain accurate year-round.

4. Use of Modern Tools

- Outsourced firms use cloud-based software for bookkeeping. This improves record accuracy.

- Business owners get instant access to reports and data. Better data leads to smart decisions.

5. Focus on Core Work

- Owners can focus more on customers and services. This brings higher satisfaction.

- Freed from number crunching, they can plan for new goals and business growth.

How Outsourced Bookkeeping for the USA Works

- Businesses share financial records with the outsourced team. This can be done securely online.

- The team enters data, matches accounts, and prepares reports. This process is smooth and fast.

- Every task is handled with strict safety measures. Data privacy remains a top priority.

- Owners get detailed reports on profit, expenses, and cash flow. With Outsourced Bookkeeping for USA companies, these reports guide better planning.

Types of Outsourcing Bookkeeping Services

1. Daily Bookkeeping

- Track every sale, bill, and expense on a daily basis; this avoids backlogs.

- Updated books show the exact status of business health at all times.

2. Payroll Management

- Handle staff payments and deductions correctly. This keeps employees satisfied.

- Ensure compliance with tax rules on wages and benefits. Errors are avoided.

3. Accounts Payable and Receivable

- Keep track of bills that must be paid on time. This avoids supplier issues.

- Monitor payments due from clients. Cash flow stays steady when receivables are tracked.

4. Bank Reconciliation

- Match every entry in bank accounts with business books. This finds mistakes early.

- Any missing or wrong entry is corrected quickly. Accuracy improves trust in reports.

5. Tax Preparation

- Prepare correct data for tax filing. This makes filing smooth.

- Timely and accurate filing avoids penalties and extra charges.

6. Financial Reporting

- Create monthly, quarterly, and yearly reports. These reflect true financial health.

- Owners can use reports for budgets, forecasts, and investment plans.

Why Outsourced Bookkeeping for USA Businesses is Growing

- More US businesses are outsourcing because it saves both time and costs.

- Cloud systems make it easier to share data and get real-time updates.

- Outsourcing gives access to skilled bookkeepers at flexible prices.

- Even small businesses can afford to outsource. With outsourcing bookkeeping services, this levels the playing field.

- Larger firms also benefit by cutting down on in-house costs and stress.

Key Features of Outsourcing Bookkeeping Services

- Detailed and accurate records are always maintained. Reports are clear.

- Delivery of financial reports is always on time. This avoids last-minute stress.

- Data is stored safely with encryption. Security stays a top concern.

- Modern software like QuickBooks, Xero, or Zoho is used. This improves accuracy.

- Service plans are flexible for both small and large businesses, making outsourcing bookkeeping services a practical option for all.

Challenges Solved by Outsourced Bookkeeping

1. Handling Complex Accounts

- Inexperienced staff may struggle with complex entries. Experts solve this issue.

- Complex accounts become simple with outsourced help. Accuracy improves when using Outsourced Bookkeeping for USA solutions.

2. Managing Seasonal Workload

- Business activity is not the same each month. Outsourcing adjusts to this.

- Workload can scale up or down as needed. Flexibility is a big advantage.

3. Avoiding Errors

- Manual errors harm accounts. Outsourced teams follow strict checks.

- Reports are double-checked for accuracy. This reduces risks.

4. Meeting Tax Deadlines

- Missing tax deadlines can cause penalties. Outsourcing prevents delays.

- Reports and returns are always prepared before due dates.

Industries that Benefit from Outsourcing Bookkeeping Services

- Retail and e-commerce businesses that deal with daily sales.

- Restaurants and food services where cash flow is high.

- Real estate firms with large financial transactions.

- IT companies and tech startups are managing fast growth.

- Health and wellness centers that need detailed records.

- Manufacturing firms with high supply chain costs.

- Service providers like consultants, lawyers, and agencies.

Why Choose Outsourced Bookkeeping for the USA

- Services are designed as per US accounting and tax rules.

- Experts understand the needs of different industries.

- Small firms save money while big firms save both time and stress.

- Guidance is given for long-term financial planning and control through expert outsourcing bookkeeping services.

Steps to Get Started with Outsourced Bookkeeping

1. Find a Trusted Service Provider

- Pick a provider with good reviews and clear skills. Trust is the first step. Check their past work and knowledge in your field. This gives you confidence.

2. Share Your Business Needs

- Explain what services you want in simple words. This avoids confusion later. Talk about your goals and pain points so they can give the right help.

3. Choose a Suitable Plan

- Choose a plan that fits your budget and firm size. Flexibility is a must. Start small and upgrade the plan when your needs grow.

4. Provide Financial Records Safely

- Send records through safe uploads or secure systems. Safety is key. Keep backup copies of files so you can get them when needed.

5. Get Regular Updates and Reports

- Ask for updates and reports at fixed times. This keeps you on track. Use these reports to make fast and smart choices for your business.

6. Ensure Clear Communication

- Set clear ways of contact, like calls, emails, or a portal. This avoids delays. Regular talks help fix issues early and keep tasks on track.

7. Check Compliance and Security

- Make sure the provider follows US tax rules and laws. Compliance is vital. Ask about strong data safety steps to keep your records safe.

8. Review Performance Regularly

- Check the work done and review reports for accuracy. This ensures quality. Share feedback often to improve service and get better results.

Security in Outsourcing Bookkeeping Services

- Firms use secure servers with strong encryption. This keeps records safe.

- Only authorized staff can access financial data. Control is strict.

- Data privacy agreements are signed. This builds trust.

- Regular checks ensure no breach or misuse of sensitive data.

Signs That You Need Outsourced Bookkeeping

- You spend more time on accounts than on running the business. This is a clear sign.

- Records are always late or incomplete. This slows planning.

- Staff costs for accounts are rising fast. Outsourcing cuts this.

- Tax season feels stressful and confusing. Outsourced experts ease the load.

- You lack regular reports to plan growth. Outsourcing provides these.

Cost of Outsourced Bookkeeping for USA Businesses

- The cost depends on what services you need. Basic or advanced.

- Small firms can choose starter packages at a low cost. Affordable and simple.

- Large firms may choose full-service plans for wider coverage.

- Even then, outsourcing is cheaper than hiring a full staff. Savings are high.

Future of Outsourcing Bookkeeping Services

- More businesses in the USA will move toward outsourcing. The trend is clear.

- Cloud tools and AI will increase accuracy and reduce errors, making Outsourced Bookkeeping for USA businesses even more efficient.

- Real-time access will become the standard for all reports.

- Outsourcing will remain a flexible, cost-saving option for every business.

Outsourced bookkeeping for USA businesses is no longer just an option. It has become the smart way to save costs, reduce stress, and focus on growth. With skilled experts, modern tools, and secure systems, outsourcing gives businesses a clear path to success.

At Meru Accounting, we provide trusted outsourcing bookkeeping services for US businesses. Our team has years of experience in US accounting and tax compliance. We use top software to ensure accuracy, speed, and data safety. We also customize services for startups, small firms, and large companies. With Meru Accounting, you get expert care, detailed reports, and peace of mind, all at cost-effective rates.

FAQs

Q1. What is outsourced bookkeeping for USA businesses?

It means hiring experts outside your firm to handle accounts. They manage records and reports.

Q2. How do outsourcing bookkeeping services save money?

You avoid full-time staff costs. You only pay for what you use.

Q3. Is my financial data safe with outsourcing?

Yes, providers use secure systems with strict privacy rules.

Q4. Can small businesses use outsourced bookkeeping?

Yes, it helps small firms save money and focus on growth.

Q5. What services are included in outsourced bookkeeping?

It covers payroll, tax prep, accounts payable, receivable, and reports.

Q6. Do outsourced teams follow US tax laws?

Yes, they are trained to comply with US rules and updates.

Q7. How do I start with outsourcing bookkeeping services?

Choose a provider, share your needs, and provide records securely.