Bookkeeping for Real Estate Agents: Key Rules and Legal Tips

Bookkeeping for real estate agents is not just about writing down numbers. It plays a big role in running a strong and legal business in the real estate field. Agents must follow clear rules to keep their books correct, safe, and in line with the law.

In this blog, we will break down the most important rules and laws that guide real estate agent’s bookkeeping. You will learn how to avoid mistakes and stay on the right path. We will also explore the common issues agents face while managing books. Next, we will help you pick the best bookkeeping software for real estate, so you can save time and cut down on errors.

In the end, we will share easy and smart steps to keep your records neat and ready at all times.

Why Accurate Bookkeeping Matters in Real Estate

1. Keeps Finances Clear

Bookkeeping for real estate agents helps track every dollar earned and spent. Each deal includes sales, fees, commissions, and costs. Without proper records, agents can lose track or make mistakes.

2. Helps With Tax Filing

Accurate records help report income and costs to the tax office. It also makes tax filing easier and helps avoid fines. Bookkeeping helps find tax breaks that can save money too.

3. Builds Client Trust

Good records show that an agent is honest and professional. Clients trust agents who manage money well. Trust can bring repeat work and a better name in the real estate field.

4. Aids Smart Choices

Bookkeeping helps agents review their earnings and spending. This shows which areas bring profit and where to cut costs. It helps you make better plans to expand and succeed.

5. Supports Legal Compliance

Agents must follow many rules. Good bookkeeping helps them stay within the law. It also helps during audits or legal checks.

Real estate agents’s bookkeeping is more than just recording numbers. It is an essential part of running a smooth, legal, and successful business.

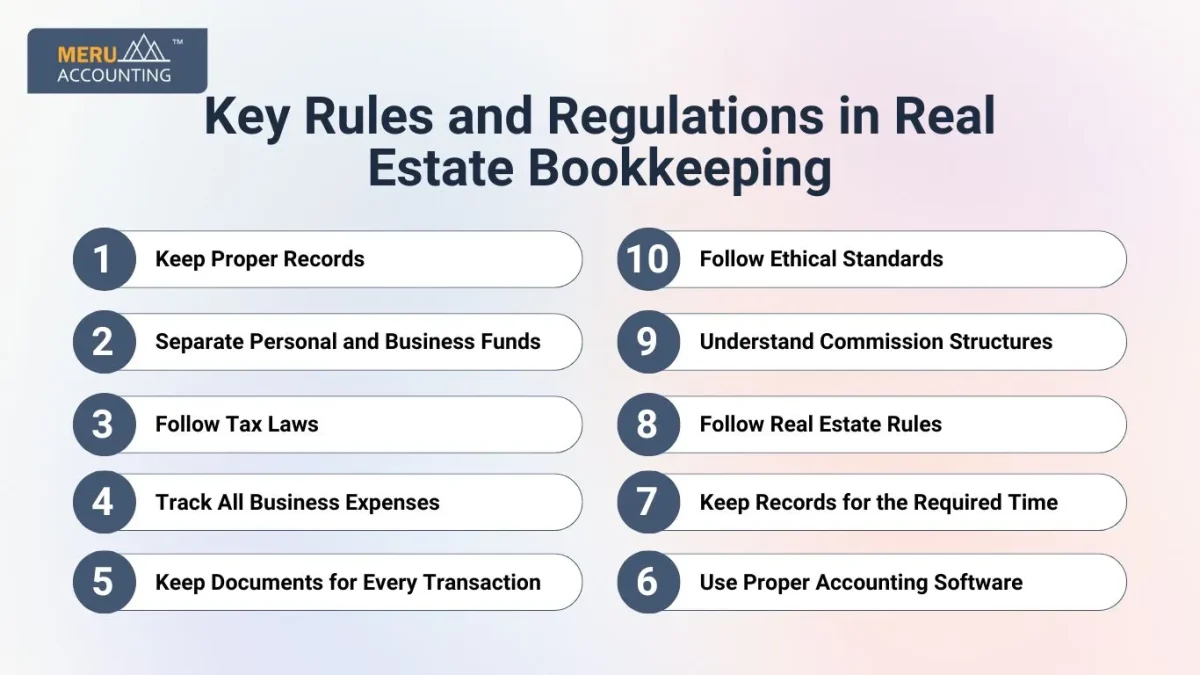

Key Rules and Regulations in Real Estate Bookkeeping

Bookkeeping for real estate agents needs a special approach with clear rules and laws. These are important rules you should keep in mind:

1. Keep Proper Records

Always keep correct records of all money transactions. This means sales, purchases, commissions, expenses, and taxes. These records must be entered carefully into the accounting books.

2. Separate Personal and Business Funds

Keep personal money and business money separate. Use different bank accounts for each. Mixing funds can cause legal and tax problems.

3. Follow Tax Laws

Real estate agents must obey all tax laws in their area. This includes paying income tax on commissions and reporting expenses that can be deducted from taxes.

4. Track All Business Expenses

KRecord all your costs clearly, including those for travel, ads, fees, and supplies. These costs must be entered correctly in the bookkeeping system.

5. Keep Documents for Every Transaction

Save all papers related to transactions. This includes contracts, agreements, receipts, invoices, and bank statements. Store these records securely so you can access them when needed later.

6. Use Proper Accounting Software

Use good accounting software to help with bookkeeping. Software can make the work faster and reduce mistakes by automating common tasks.

7. Keep Records for the Required Time

Keep all records as long as the law says. Most times, that means 3 to 7 years. It helps during audits or tax checks.

8. Follow Real Estate Rules

Make sure bookkeeping follows all real estate rules and regulations set by local authorities. This keeps the business legal and in good standing.

9. Understand Commission Structures

Know how commissions work in each deal. It helps keep income records clear and track profits accurately.

10. Follow Ethical Standards

Always act with honesty and professionalism in all money matters. Avoid conflicts of interest and be open about any issues. Ethical behavior matters a lot in real estate bookkeeping.

By following these rules and regulations, real estate agents can keep their bookkeeping legal and accurate. This makes managing finances easier and builds trust with clients and authorities.

Common Bookkeeping Challenges Faced by Real Estate Agents

1. Managing Multiple Transactions

Real estate agents often handle many deals and clients at the same time. This means lots of transactions to keep track of. Without a clear system, it is easy to mix up payments or miss recording something.

2. Tracking Commission Payments

Commissions come from different sales and may arrive at different times. Agents need to carefully record who gets what share, especially when splitting commissions with brokers or partners.

3. Keeping Expense Records Clear

Real estate agents have many types of expenses, such as marketing, travel, office supplies, and license fees. Sometimes business and personal expenses get mixed up.

4. Handling Client Trust Accounts

Agents often hold deposits or escrow funds for clients. Laws require these funds to be kept separate from the agent’s own money. Managing these client trust accounts carefully is a challenge, and any mistake can lead to legal trouble.

5. Choosing the Right Bookkeeping Method

Many agents struggle to pick a bookkeeping system or software that fits their needs. Using the wrong method can cause inefficiency and mistakes. It is important to choose a system that matches the complexity of real estate bookkeeping.

6. Staying Compliant with Rules

Bookkeeping for real estate agents must follow many rules and regulations. Keeping up with these rules and making sure all records meet legal standards can be tough without expert knowledge.

Choosing the Right Bookkeeping Software for Real Estate Agents

Picking the right bookkeeping software for real estate agents makes bookkeeping easier and more accurate. The right software can save time, reduce mistakes, and automate many tasks.

1. Client Fund Management

The software should handle client deposits and escrow funds separately. This keeps client money safe and clear.

2. Commission Tracking

It must let you record commissions, splits, and payments with ease. This helps track income well.

3. Expense Management

Look for software that tracks business costs clearly and lets you attach receipts. This keeps expenses organized.

4. Integration with Other Tools

Good software should connect with tax software, bank accounts, and real estate platforms. This makes the work smooth and less manual.

5. Reporting Features

The software must create clear financial reports and summaries. These reports help understand the business’s health.

6. Easy to Use

The software should be simple enough for anyone, even without accounting skills. It helps you work faster while keeping errors low.

Many real estate agents say that having the right bookkeeping software improves how fast and accurately their work is.

Best Practices to Maintain Accurate Books in Real Estate

To keep bookkeeping easy and correct, it helps to follow some proven steps. These steps will help keep records clean, avoid mistakes, and stay ready for tax time.

1. Update Records Often

Do not wait till the month-end. Update your books each day or week. This keeps things fresh and avoids mix-ups.

2. Keep Business and Personal Money Apart

Use a different bank account for your business. This makes it easier to track work costs and file your taxes correctly.

3. Use Bookkeeping Software

Bookkeeping software for Real Estate Agents is designed to reduce errors and save time by efficiently tracking sales, expenses, commissions, and escrow accounts.

4. Match Bank Records

Each month, match your bank records with your books. This helps spot errors before they grow into bigger issues.

5. Keep Copies of Everything

Store both paper and digital files. Keep contracts, bills, and slips in a safe place. You may need them for taxes or audits.

6. Get Help if Needed

If books seem too tough, talk to a pro. A good bookkeeper or firm can help you stay on track and follow all the rules.

7. Stay Up to Date on Laws

Tax and real estate rules can change. Keep an eye out and adjust your records as needed.

Following these steps makes real estate bookkeeping easier. The right bookkeeping software for Real Estate Agents helps in saving time, minimizing errors, and staying prepared for tax season.

Real estate agents’ bookkeeping needs focus and strict rule-following. The right bookkeeping software, along with smart steps, keeps the process smooth and stress-free. Meru Accounting offers expert bookkeeping for real estate agents. We help you stay on track, stay clear, and be ready for audits at any time.

FAQ

- What is bookkeeping for real estate agents?

Real estate agents’s bookkeeping means writing down and managing all money transactions linked to their property sales, commissions, costs, and client funds. - Why do real estate agents need special bookkeeping software?

Special software designed for Bookkeeping for Real Estate Agents simplifies managing escrow funds, tracking commissions, and recording property expenses. - What is the best schedule for real estate agents to keep their books updated?

It is best to update bookkeeping daily or weekly to avoid mistakes and keep records correct. - Can real estate agents do bookkeeping without software?

They can, but doing it by hand can cause errors and take more time. The software makes bookkeeping easier and more accurate. - How can bookkeeping make tax filing easier for real estate agents?

Bookkeeping keeps clear records of income and costs. This makes tax filing simple and helps agents get the right tax breaks.