Home » Wave » Accounting & Bookkeeping » Simple Steps for Bank Reconciliation

Simple Steps for Bank Reconciliation

You get money from sales, and you pay money for things like supplies and rent. You may use a bank account to handle all this. But sometimes, your bank account balance and your records may not match, and to solve this, you need to do a bank reconciliation.

Doing a bank reconciliation means checking your records with the bank’s records. This helps you make sure your money is correct. If something is wrong or missing, this process helps you find the mistake.

In this guide, we will show you simple steps to follow. It’s called the bank reconciliation process, and we’ll also give you a clear bank reconciliation checklist.

What Is Bank Reconciliation?

Bank reconciliation means checking your money records with the bank statement. You want to make sure the amount of money you show in your books is the same as the amount the bank shows.

This is important because:

- You may have written down a payment, but the bank has not shown it yet.

- The bank may have charged a fee that you forgot to write down.

- A check you gave to someone may not have been cashed yet.

- There may be mistakes or missing numbers.

The goal is to match both records so that they show the same amount.

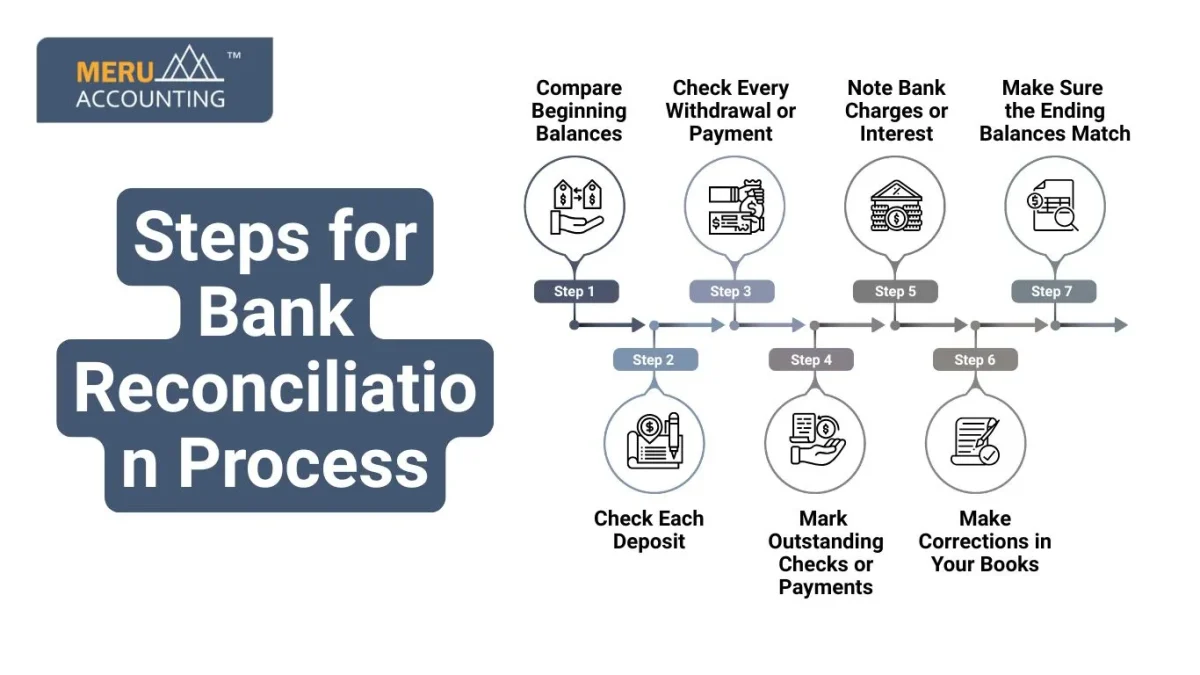

Steps for Bank Reconciliation Process

Step 1: Compare Beginning Balances

Start by looking at the beginning balance on your bank statement and the balance in your books. These numbers should match. If they don’t, go back to the last month you checked and look for the mistake.

Step 2: Check Each Deposit

Look at every deposit in your bank statement. Now check each one against your records. Ask:

- Did I write this deposit in my books?

- Is the amount correct?

- Did I miss anything?

Sometimes a deposit might be in your records but not in the bank yet. Mark it as a timing difference.

Step 3: Check Every Withdrawal or Payment

Look at every payment, fee, or charge in the bank statement. Then check your business records. Ask:

- Did I write this payment down?

- Is the amount the same?

- Did I forget to record a bank fee?

If something is missing or wrong, make a note of it.

Step 4: Mark Outstanding Checks or Payments

If you gave someone a check and they haven’t cashed it yet, it won’t show in the bank. This is called an outstanding check. Keep track of these so you don’t forget about them later.

Step 5: Note Bank Charges or Interest

The bank may charge you for services or give you interest if you earned any. Write down these charges or earnings in your records if they are not already there.

Step 6: Make Corrections in Your Books

If you missed a payment, deposit, or fee, now is the time to fix it. Make sure your records are correct. This is a key part of the bank reconciliation process.

Step 7: Make Sure the Ending Balances Match

Now look at the final number. The ending balance in your books should be the same as the ending balance on the bank statement after you add or take away any differences, like checks that have not cleared. If it does not match, go back and check each step again.

Simple Bank Reconciliation Checklist

You can use this bank reconciliation checklist each month to stay on track and make sure your records match the bank:

- Check the Beginning Balances: Make sure the starting number in your books matches the bank’s starting balance.

- Match All Deposits: Look at every deposit in your bank statement and match it with your records.

- Match All Payments and Withdrawals: Check each payment or withdrawal to see if it is in your business records.

- Mark Outstanding Checks or Deposits: If you wrote a check or made a deposit that is not in the bank yet, write it down.

- Add Bank Charges or Interest: Write down any bank fees or interest that appear on your bank statement.

- Fix Any Missing or Wrong Entries: If something is missing or wrong in your books, fix it right away.

- Check That Your Final Balance Matches the Bank: After all changes, your ending balance should match the bank’s ending number.

- Save Your Notes and Files: Keep your bank check and notes for later.

Importance of Bank Reconciliation

The bank reconciliation process is very important for your business. Here’s why:

- Catches Mistakes Early: If you or the bank makes a mistake, bank reconciliation helps you find it before it causes trouble.

- Stops Fraud or Theft: If someone takes money without your consent, this process helps you spot it quickly.

- Shows Your Real Balance: The bank reconciliation process tells you how much money you really have in your account.

- Helps You Get Ready for Taxes: When you do bank reconciliation each month, your records are clean and ready for tax time.

- Helps You Plan Better: Knowing your true balance helps you make smart plans and choices for your business.

Even though it seems small, the bank reconciliation process keeps your business strong, safe, and clear.

Doing a bank reconciliation may seem hard at first, but it gets easier each time you do it. When you follow the steps and use the bank reconciliation checklist, you can keep your money records right and safe.

If you’re busy or unsure how to do it, you don’t have to do it alone. Meru Accounting can help. We are experts in the bank reconciliation process and can handle your books for you. With Meru Accounting, you can focus on your business while they keep your records neat and correct.

FAQs

Q1. Can I do bank reconciliation by hand, or do I need software?

You can do it by hand with a calculator and notebook. But using software or accounting help makes it faster and easier.

Q2. What if my balances don’t match at the end?

Check for missing deposits, payments, or errors. If you still can’t find the issue, ask a pro like Meru Accounting to help.

Q3. How long should bank reconciliation take?

It depends on how many payments and deposits you have. A small business may need 30 to 60 minutes once a month.

Q4. What if I missed a bank fee last month?

Write the date and what it was for so your records stay correct going forward.

Q5. Can Meru Accounting do bank reconciliation for me?

Yes, Meru Accounting offers full help with the bank reconciliation process. They can also handle your books, taxes, and more.